Marketers need to regain a sense of control as they work through some difficult decisions. Changes in media consumption, and changes in how consumers research and shop are causing us to react amidst a level of uncertainty we haven’t had to navigate before.

Combine this uncertainty with a sense of urgency that is permeating a lot of marketing organizations right now, and you end up with a pretty combustible mix that can lead to some ill-advised decisions. It may feel like the future is so unknowable such that it renders the past of little value, however, there is a lot we can learn by working with the data we have on-hand.

Watch free webinar on-demand: Data-informed Budget Changes

This concept of regaining control through data is critical now more than ever because we’re seeing some far-reaching decisions being made in an arbitrary or ‘shoot-from-the-hip’ way. Marketers have spent years trying to incorporate data into their decision-making frameworks and striking a balance between art and science, but what we’re seeing now during this crisis is that both art and science are being cast aside in favor of highly reactive decisions that have major implications for the organization.

What should I be spending on media right now?

Making un-informed changes to media investments provides a false sense of security and control right now because the true optimal level of investment might well be even lower, or higher, than what your gut would point you to.

The Optimal spend range analysis is a structured way to extract value from historical data you have on hand to inform your ideal media spend without sacrificing speed. It’s a flexible and fast way to incorporate data into your marketing investment strategy while still leaving enough flexibility to factor in the changing landscape we’re all facing right now.

We recently activated this approach for a major retail client. Historically, like a lot of marketers, they anchored future media spend to past spend levels with a factor applied for the expected performance of the business. The challenge now is that business is not as usual, and this approach was quickly losing relevance in today’s marketplace. There was also a mandate to re-examine every dollar to see if we could identify ways to improve performance, save spend, and ideally both.

We looked at this brand’s historical data – data that was on-hand – and crafted a fast and flexible model that would help us narrow the consideration set for optimal spend levels.

The methodology is relatively straightforward.

Define your critical KPIs

First, we review how we define performance by assessing KPIs and making sure we’ve got the right measures of success in place. This is evolving for a lot of brands right now and using this as our starting point helps to ensure maximum applicability and relevance.

This first step is possibly the most important. Gaining alignment on how you define performance and how you measure that performance sets the tone for where to focus the analysis. This is also where we can inject relevance in a time of change and uncertainty. By taking a beat to think critically about the KPIs you want to influence, you can ensure that this optimal spend range analysis produces applicable results downstream.

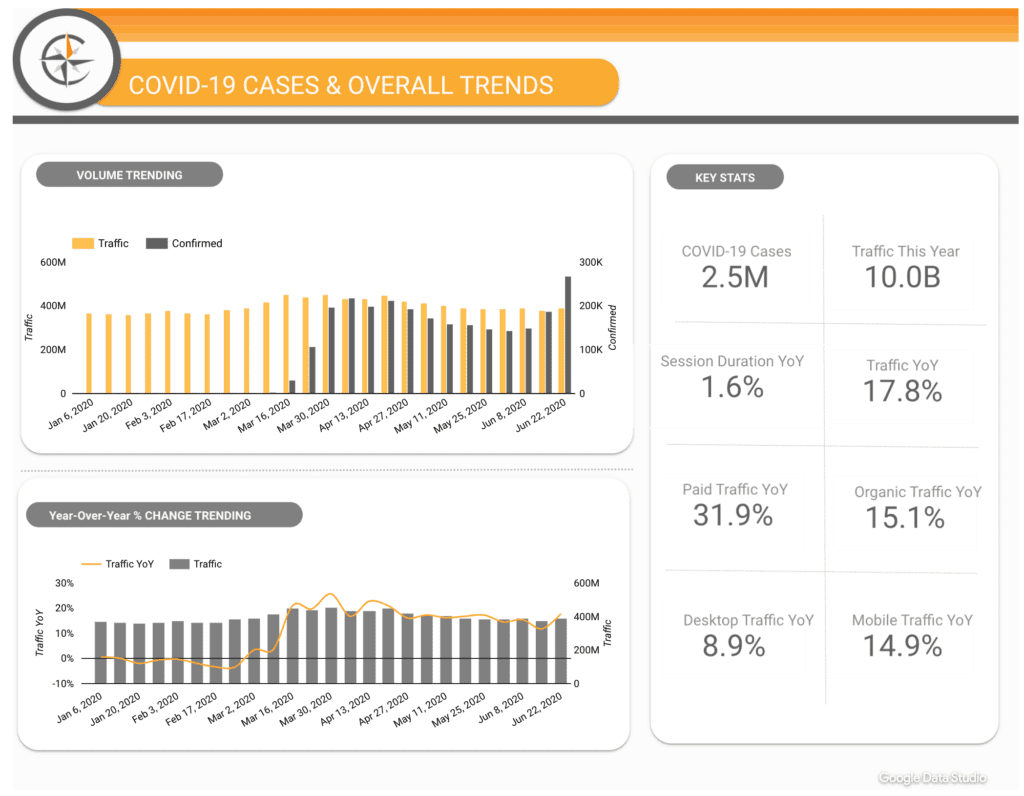

Analyze 2+ years of historical data

From there, we access and organize two or more years of historical data. We’re looking to understand the downstream performance relating to our re-established KPIs and how different spend impacts performance.

Whether you have a single focused KPI or are looking to maximize performance against a basket of KPIs, a historical review of actual performance data helps to zero-in on which spend ranges deliver the best performance. A quick visualization of this data will help to simplify the story and generate faster buy-in across your organization when important decisions are at stake.

This part of the process is intentionally flexible. For example, if we observe a performance lag trailing investment, we can incorporate that lag time into our work. The output from this analysis identifies a set of best-performing spend ranges which we can then test in the market to see how well actual performance holds up to the model. All in, depending on data availability, this analysis can be done in just two weeks.

Validate performance

Further evaluate relative performance across varying spend levels to understand how to influence performance.

In this example, you see that Figure 1 highlights a span range between $150,000 and $160,000 that delivered significantly above average for this primary KPI. We also observed that at about two times that level of spend (Figure 2) there’s consistent over- performance. Now we’re starting to narrow down with a level of confidence that a spend level in the range of $150,000 per week can reliably deliver strong performance. We’ve also identified a higher level that may be appropriate for peak weeks or supporting key events and promotions.

Identify best performing spend ranges

From there you can compare and contrast performance across multiple different spend ranges. At this point, your business priorities will guide interpretation.

For this client, the goal was to maximize savings and minimize performance impact. That $150,000 spend range rose to the top as it allowed us to over-deliver across all KPIs versus the average while still bringing weekly media spend levels down. This is powerful information to bring to the table and a convincing way to ensure data comes back into the decision-making process.

Test and Refine

The next steps are to test out these revised weekly spend levels and observe performance to see how closely actuals align with the forecast. Our analysis uncovered potential cost savings of nearly $3,000,000 annually without sacrificing performance. In the face of uncertainty, we were able to tap into existing data sets to deliver a sense of control and serve as a voice of reason in an anxiety-driven business climate.

Concluding thoughts

No one wants to save costs at any cost. With the uncertainty generated during this crisis, it becomes more important than ever to regain a sense of control by using data to help answer the tough questions. Doing this kind of optimal spend band analysis is a quick way to dig into the data that you have and maximize cost savings while minimizing performance impact.