The Pareto Principle states that, for many events, roughly 80% of the effects come from 20% of the causes. The same is likely true for your marketing efforts: 80% of revenue can be attributed to 20% of your customers. Not all customers are created equal and those who are valuable should be retained.

One of the most common forms of advanced data analysis we are asked to perform by our clients is that of “Customer Lifetime Value” (CLV) or “Lifetime Value” (LTV). In many cases, that request has been sitting on the client’s “to do” list for a very long time as few businesses are currently measuring CLV. Why? For one, calculating it is hard work. It requires multiple years of data at the right level of granularity, the foresight to capture the necessary join key, and the overall time, resources, and specialized skills that may not be readily available. What most businesses have in common is that they’re aware of the importance of CLV.

Businesses analyzing their data in silos are missing the full picture. Google Analytics data and CRM data provide a host of information on their own but are even more powerful when combined. By combining these two groups of data, businesses will be more capable of understanding true Lifetime Value.

What is Lifetime Value?

Depending on who you ask, this can be a loaded question. Formulas for calculating LTV differ from business to business and analyst to analyst. But for the purposes of this blog post, E-Nor is starting at the definition given by the Harvard Business Review:

“The amount of profit your company can expect to generate from a customer, for the time the person (or company) remains a customer (e.g., x number of years).”

Different from the above definition, E-Nor considers LTV to be based on the amount of revenue a user can expect to generate, not profit. Lifetime Value uses the amount of revenue generated by segments of customers in order to gain an understanding of ideal Cost Per Acquisition (CPA) for future customers.

Why Calculate LTV?

Use cases for LTV will vary depending on the business model. Some use cases include:

- Identifying your highest-value customer segments

- Creating cohorts of users for testing purposes

- Identifying likely high-value customers earlier in the customer lifecycle

- Combining LTV and customer segment data with product-purchase data to build matrices of purchase behavior

Identifying data points like those above requires disciplined and dedicated analysis. The payoff is significant once completed, but businesses should not expect to come at answers quickly or easily.

In the following sections, we will discuss the requirements for getting started on your LTV analysis.

Can I use the Google Analytics Lifetime Value Report For This Analysis?

The value you will gain from this report (still in Beta) is largely dependent on what you are hoping to get out of LTV analysis. For those looking to do sophisticated analysis, this will not be the tool for you. However, for users looking for high-level insights, this may be a good starting point.

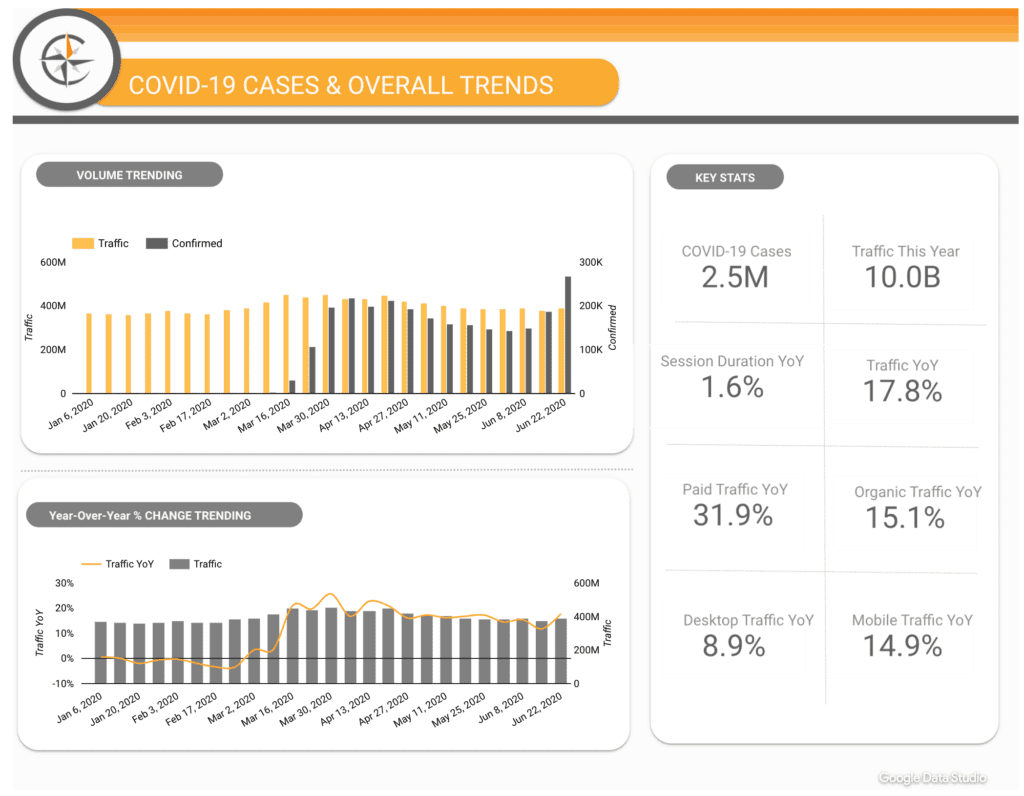

In this report, you can set the Acquisition Date Range to your desired range and see an LTV Metric for the first 90 days after acquisition. Revenue Per User is the default metric but you have the ability to select from others or compare them to one another.

The name of the report is a bit of a misnomer, as you truly cannot see lifetime value from this report. The report shows the value of a particular dimension over the course of 90 days after acquisition.

For some businesses, this may be sufficient. You may only need to see the Revenue Per User from a specific short-term campaign. Or maybe you want to know which traffic source drove the greatest number of high-value users in the 90 days following acquisition date.

Businesses hoping to look beyond a 90-day window can begin here but will need to take additional steps.

To make the strongest use of the GA Lifetime Value report, E-Nor recommends enabling User ID tracking (if possible) and viewing this report in the User ID Enabled View. Otherwise, the same user visiting on their desktop and then mobile will be viewed as two separate users.

Prerequisites for LTV Analysis

To prepare for Lifetime Value analysis, there are several fundamental pieces which need to be in place.

- Access to your Google Analytics data and Transaction-Level/Customer-Level Data from another source, like a CRM.

- The ability to tie together user-and-transaction level data from both sources.

In order to successfully blend this information, you will need to have a common join-key that is present in both data sources and can identify both users and their transactions. Especially with recent GDPR considerations, it is important you are compliant with Google Analytics policies when tracking variables like User ID.

Some methods for joining this data include:- Read the Lead ID or Contact ID from your CRM and record it in GA as a Custom Dimension.

This value can also be used for User ID Tracking in Google Analytics. - Read the Client ID from the _ga cookie and record as a Custom Dimension in GA and a Custom Field in your CRM.

- Randomly generate a unique text string and record it as a Custom Dimension in GA and a Custom Field in your CRM.

- Read the Lead ID or Contact ID from your CRM and record it in GA as a Custom Dimension.

- A method for joining your data together.

Right now, your Google Analytics data is in Google Analytics and your CRM data is in your CRM. You’ve created a common key between those two data sources, but where do you go from there?

You have a few options.- BigQuery (or another Data Warehouse)

BigQuery is Google’s premier Data Warehouse and one E-Nor strongly recommends. GA360 customers have a particular advantage with BigQuery since they receive a $500/month credit towards housing their data. Integrating Google Analytics 360 with BigQuery comes with a host of other benefits. - GA Core Reporting API

This may be an option for non-360 users who do not want to pay for BigQuery services. If you are capturing Client ID, User ID, and timestamps for GA sessions as custom dimensions, you can pull transaction data down and start your LTV analysis. Having access to back-end customer file data along with solid back-end transaction data will make this process smoother.

- BigQuery (or another Data Warehouse)

- Acquisition Costs **Optional but recommended!

Having access to your spend data is a recommended prerequisite but isn’t 100% necessary to a successful LTV analysis. Incorporating acquisition costs into your analysis can make it stronger and allow for greater segmentation. You might ask questions like, what are the differences in purchasing behavior for users in a high-cost and low-cost Acquisition group?

Requirements for LTV Analysis

- At least one full year of customer/user-level data (preferably two) from both data sets

- Access to someone internal or external to your organization who is capable of normalizing the data to the dimensions described below.

This might be an individual in your business-analysis department or maybe just someone passionate and dedicated enough to get the job done! The emphasis here is that LTV analysis is a intensive process, so it should ultimately be someone with the time and resources to do the work. An understanding of statistics is quite helpful as well.

You may even look to a team within an agency, like E-Nor’s Data Intelligence Team to handle this type of project.- Normalizing to Acquisition Date

This refers to being able to organize your users into buckets like Day 0, Day 1, Day 2 or Week 0, Week 1, Week 2, and so on.

This is critical, as failing to do so will result in the oldest customers always being overvalued and the newest customers also being undervalued. You will want to normalize this to the day, week, or month of acquisition date, depending on how granular you want your analysis to be.

For example, users who are acquired on January 1, 2018 will be set at Week 0 and progress forwards from there. Users who are acquired on February 1, 2018 will be set at Week 0 and progress the same. When you compare LTV, you should be comparing against the date bucket. Unless you do this, users who have been in your database longer will have a greater value by virtue of their length of time in the database.

You can see this at play in the Lifetime Value Report in Google Analytics. In that report, you set your date type to Day, Week, and Month and then view users bucketed by their normalized Acquisition Date.

The Google Analytics LTV Value Report is an example of how your data can be normalized to acquisition date - Normalized to a Closed Time Limit

Instead of asking the broad questions of “What is my total customer lifetime value,” it is better to ask the question, “What is our 3-year LTV? What is our 5-year LTV?” This should be based on what you know of the following variables for your business:- Average Customer Lifespan: How long, on average, your users remain customers

- Customer Retention Rate: The percentage of customers who repurchase in a given time period compared to an equal and preceding time period (Source for definition) (E-Nor Blog Post)

- Churn Rate: The inverse of Customer Retention Rate, or the percent of users who did not repurchase or whom you lost.

- Time to General Profitability Against Acquisition Costs: Is your business in the “Loss Leader” Model, where you introduce new customers at a high cost in the hope of building a customer base or securing future revenue? In this case, that time may be a longer length than businesses with lower acquisition costs and lower profitability.

- Rate of Discount: This is generally set to 5-10% but needs for your business may differ.

- Normalizing to Acquisition Date

After getting through all your Prerequisites and Requirements, it’s time to visualize your data and start drawing some inferences.

Considerations for Visualization and Analysis

- Resources

You will need someone to create trended and segmented graphs visualizing customer LTV over time. These should visualize how customer LTV accumulates from Acquisition Day 0 (or week 0, or month 0) up to the LTV window determined for the analysis. - Visualization Tools

There are many visualization and business-analysis tools on the market currently. You might employ Tableau, PowerBI, DOMO, or another tool altogether. - Segments to Analyze

Your visualizations will be most valuable when they are segmented. Some customer segments will show clear and significant differences in initial and short-term purchase characteristics which are predictive of much higher long-term value.

These may be in terms of Average Order Value, Repeat Purchase Rates, and/or Customer Tenure. These performance differences will often be tied to attributes, such as value of first purchase, whether or not a customer made a repeat purchase within the first 30 days of first purchase, etc.

The segments you consider will be unique to your business. See the table below for some ideas for how to segment with Google Analytics data.

| Segment Name | Ideas for Segmenting |

|---|---|

| Campaign | Winter vs Fall Catalog, New Home Buyers |

| Marketing Tactic | Paid Search, Paid vs Internal Email, Affiliate Marketing, Display, etc. |

| Marketing Audience | Prospecting (new users) vs Retargeting to Long-Lapsed Users |

What’s Next?

Once identified, characteristics of existing high-value user groups can be used for targeting future new users. Target CPAs may be set higher for these high-value individuals or markets, knowing the payoff will likely be higher than for a general audience.

For example, you may learn that users who have subscribed for over a year and engage with emails continually are 50% more likely to purchase another product than those who do not engage with email. This type of learning may warrant spending more in a retargeting campaign for that high-value audience.

During your analysis, you could give users a “score” and create your campaign based on scores exceeding a certain threshold. You might create a user-scoped Custom Dimension for “Lifetime Value Score” and push that score into the dataLayer and your Custom Dimension index. You could then create Audiences in GA filtered by scores exceeding that threshold. From there, you can create campaigns targeted at those Audiences.

The Rewards of LTV Analysis

While accurately assessing Lifetime Value does require significant groundwork, the payoff is significant. After performing this analysis, you will be able to identify the characteristics of your highest-value customers and target similar groups. It is less costly to retain your highest-value customers than it is to acquire them, so you’ll be able to spend smarter and not more.